The Full Story about Gaps in Homeownership

Stephen L. Ross*

John Yinger*

November 4, 2002

Hartford Currant

At a recent White House conference on increasing minority homeownership, President Bush highlighted the fact that black and Hispanic families continue to have much lower homeownership rates than white, non-Hispanic families. “It’s a gap that we’ve got to work together to close,” the president said, “for the good of our country, for the sake of a more hopeful future.” The president’s objective is admirable, but his recent proposals fail to address a key contributor to this homeownership gap: discrimination in mortgage lending.

For years, mortgage discrimination has been swept under the rug by the federal government, which refuses to collect the information needed to measure it. A careful study based on 1990 data by scholars at the Boston Federal Reserve Bank found that black and Hispanic applicants were 82 percent more likely to be turned down for a mortgage loan than were equally qualified whites. The federal financial regulatory agencies (such as the Federal Reserve Board and the Office of the Comptroller of the Currency), the major secondary mortgage market institutions (such as Fannie Mae and Freddie Mac) and the U.S. Department of Housing and Urban Development all have the ability to collect the information needed for another study of this kind, but not one of them has done so.

Even more troubling is the failure of the federal financial regulatory agencies, which have the main responsibility for fair-lending enforcement, to implement effective enforcement techniques.

This nation’s fair-lending laws prohibit two forms of discrimination: disparate treatment and disparate impact. Disparate-treatment discrimination arises when a lender uses different standards to evaluate loan applications from families with different racial or ethnic backgrounds. Disparate-impact discrimination arises when lenders use the same rules for everyone, but the rules place families in certain racial or ethnic groups at a disadvantage without any business justification. A history of paying rent on time, for example, might be a good indicator of creditworthiness, and ignoring rent-payment history for all loan applicants might have an unjustified disparate impact on blacks, Hispanics, and other groups with a high share of renters.

The enforcement techniques used by the financial regulatory agencies are explicitly designed to capture the most dramatic cases of disparate-treatment discrimination by large lenders, but they fail to find many other cases of disparate-treatment discrimination and do not even bother to look for disparate-impact discrimination.

Some people have argued that the rise of credit scoring and other types of automated underwriting schemes, some of which operate over the Internet, should minimize discrimination because the loan approval decisions are automated and the lenders may not observe the customer’s racial or ethnic identity. This claim may accurately reflect developments in disparate-treatment discrimination (although there is no evidence to back it up), but it does not apply to disparate-impact discrimination, which operates even when a lender does not know if a customer is black or Hispanic. In fact, there are good reasons to believe that disparate-impact discrimination could be magnified by a move to automated underwriting, where it can be hidden in the weights placed on the various factors in an underwriting scheme.

Moreover, current fair-lending enforcement procedures turn a blind eye to disparate-impact discrimination and therefore create a loophole that can be exploited by any lender who wants to discriminate.

President Bush has called for a modest amount of spending to support down payments for low-income families, to subsidize affordable housing and to counsel potential homeowners. These programs are unlikely to lower homeownership gaps significantly unless black and Hispanic households can obtain mortgage loans on a nondiscriminatory basis. The federal government needs to provide regular information on the extent of mortgage lending discrimination and to adopt fair-lending enforcement procedures capable of identifying discrimination no matter what form it takes.

If President Bush and other public officials are serious about, in his words, “dismantling the barriers that prevent minorities from owning a piece of the American dream,” they must stop sweeping mortgage lending discrimination under the rug.

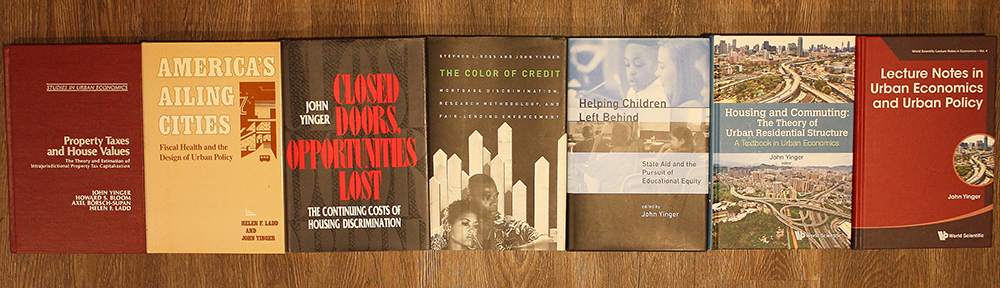

Stephen Ross is an Associate Professor of Economics at the University of Connecticut. John Yinger is Trustee Professor of Public Administration and Economics at The Maxwell School, Syracuse University. Copyright 2002, Hartford Courant