SYRACUSE UNIVERSITY

Maxwell School of Citizenship and Public Affairs

PAI 786 – Urban Policy

Professor Yinger

Case: Promoting Integration(1)

The last few years have witnessed a quantum leap in the enforcement of fair housing and fair lending legislation. The 1988 Fair Housing Amendments Act gave new enforcement powers to the U.S. Department of Housing and Urban Development (HUD) and the Department of Justice. For example, HUD can now initiate complaints against housing agents who discriminate (Kushner 1992). The Clinton Administration has been learning how to put these new powers to use, and the budget submitted by the Clinton Administration in January 1998 called for doubling the resources devoted to fair housing enforcement. Moreover, several events, including release of the Home Mortgage Disclosure Act data, which show wide disparities in loan acceptance rates between whites on the one hand and blacks and Hispanics on the other,(2) have led financial regulatory agencies such as the Federal Reserve Board and the Office of the Comptroller of the Currency to increase their anti-discrimination enforcement.

Some scholars have argued, however, that these commendable enforcement efforts may fall short of the mark because they are likely to have little impact on one of the principal sources of discrimination by real estate brokers and landlords, namely residential segregation.

Residential segregation, the physical separation of racial or ethnic groups, is a principal cause of continuing discrimination in housing;

Enforcement efforts directed toward people who commit discriminatory acts are unlikely to have much effect on segregation;

The federal government needs programs to attack segregation directly, that is, to support integration, as part of its anti-discrimination arsenal.

Because of this argument, the U.S. Department of Housing and Urban Development has begun an investigation into alternative policies for promoting residential integration.

Evidence of Residential Segregation and Discrimination

Residential segregation is a particularly striking feature of most urban areas in the United States. Blacks and whites, and to a lesser extent Hispanics and non-Hispanic whites, tend to live in different neighborhoods.

The best known measure of residential segregation is the dissimilarity index (Massey and Denton 1993). A value of 100 for this index corresponds to complete segregation of the two groups from each other, and a value of zero signals an even distribution of the two groups throughout all neighborhoods. Intermediate values indicate the share of the population of either group that would have to move to obtain an even distribution.

Black-white segregation indexes have been quite high, above 70, for many decades, with a slow downward trend beginning in 1970. Among the 23 urban areas with the largest black populations in 1990, which contain about 46 percent of the nation’s black citizens, the average segregation index dropped from 78.8 to 74.5 between 1980 and 1990 (Farley and Frey 1993; Farley 1993). Even with the segregation declines in these areas, therefore, three-quarters of the blacks (or the whites) would have to move to achieve an even racial distribution. Hispanics are considerably less segregated from non-Hispanic whites than are blacks, but Hispanic-white segregation is moderately high and growing in many places. In the 20 urban areas with more than 200,000 Hispanic residents, which contain 59 percent of the nation’s Hispanics, the average segregation index increased slightly during the 1980s, from 48.0 to 48.9 (Farley and Frey 1994).

Recent evidence of discrimination in the sale or rental of housing is based on a technique called a fair housing audit. Two teammates, one white person and one person from a minority group, who have been closely matched to be equally qualified for housing, successively visit a landlord or real estate broker in search of housing. Each teammate’s treatment is then recorded. Because teammates differ only on minority status, discrimination exists whenever minority auditors are systematically treated less favorably than their white teammates.

National audit studies conducted in 1977 and 1989 and dozens of audit studies conducted in individual cities during the 1980s and 1990s find clear evidence of discrimination (Wienk et al. 1979; Turner, Struyk and Yinger 1991; Galster 1990b, 1990d; Yinger 1986a, 1995). Housing agents limit the information minority households receive about available housing and take actions that add annoyance, complexity, and expense to minorities’ housing search process. The 1989 national Housing Discrimination Study, for example, found that between 5 and 10 percent of the time, all information about available housing units was withheld from black and Hispanic customers; that black and Hispanics home buyers and black renters were informed about 25 percent fewer housing units than comparable whites; and that whites were significantly more likely than blacks or Hispanics to be offered assistance in finding a mortgage, to receive a follow-up call from the housing agent, or to hear positive comments about an available house, apartment, or apartment complex (Yinger 1995). This study also found that real estate brokers sometimes practice racial or ethnic steering, which is defined as directing a customer toward neighborhoods in which people of his or her racial or ethnic group are concentrated (Turner, Mickelsons and Edwards 1991). Other recent research has uncovered discrimination in real estate advertising and marketing (Turner 1992; Galster, Freiberg and Houk 1987).

Several recent studies also document discrimination in mortgage lending. One study based on 1990 data for the Boston area finds that, after accounting for all the applicant, property, and loan characteristics that lenders say they consider, minority applicants are turned down 80 percent more often than comparable whites.(3) Additional evidence indicates that some lenders discriminate in advertising and outreach, in pre-application procedures, and in loan terms, and that their discrimination is reinforced by the discriminatory actions of insurers and appraisers (Yinger 1995).

The net effects of all this discrimination are severe constraints on the ability of many minority households to buy houses and a lack of access to credit in many minority neighborhoods.

The Role of Segregation in Supporting Discrimination

It is well known that discrimination in housing and mortgage markets is a key cause of segregation. After all, segregation results when minorities are denied access to housing in white neighborhoods. What is not so widely recognized, however, is that segregation is also a key reason why discrimination is so hard to eliminate–an outcome that becomes a cause.

Racial and ethnic prejudice, defined as irrational suspicion or hatred of a particular group, thrives in a world in which different racial and ethnic groups rarely live in the same places.(4) Without widespread, stable opportunities for different racial and ethnic groups to live and work together, the stereotypes and ignorance that feed prejudice are unlikely to disappear.

Segregation also shapes the behavioral responses that accompany prejudicial attitudes. Prejudiced white households flee racially or ethnically changing neighborhoods in part because they have almost no examples of stable integration to observe and in part because they have so many stable all-white areas to which they can flee. If groups were distributed evenly (that is, if the segregation index were close to zero), then no white household would have an incentive to move away from people against whom it is prejudiced.

This white prejudice and these white actions in turn give landlords, real estate brokers, and lenders an economic incentive to discriminate in relatively stable white areas or to encourage racial or ethnic transition once it has begun. A housing agent whose office or apartment building is located in a white neighborhood is likely to derive most of his business from white clients and have an economic incentive to protect his reputation with whites. This agent’s reputation, and hence his business prospects, may be damaged if he sells or rents to a black or Hispanic household. In the sales market, this type of action also may damage his reputation among other brokers and thereby undercut cooperation from them. Because so many houses are now sold through multiple listing services (MLS) and other cooperative arrangements, this lack of cooperation can harm an agent’s income. See Yinger (1995).

However, if an agent draws business from a neighborhood where racial or ethnic transition is taking place, he may expect most of his future customers to be black or Hispanic and his incentive to discriminate against these groups disappears. In fact, because a real estate agent’s income is derived from commissions, he may encourage turnover by selling to minority households in neighborhoods where racial or ethnic transition has begun or is anticipated.(5)

Thus segregation plays a key role in giving housing agents an incentive to manipulate the racial and ethnic composition of neighborhoods by discriminating in some cases and encouraging transition in others.(6) Even with active fair housing enforcement, many housing agents will find a way to discriminate if they have a strong economic incentive to do so. An effective enforcement system therefore must address the extent of racial segregation and not simply leave it in the hands of the discriminators themselves.

Markets’ Failure to Provide Integration

Housing markets have not been very successful in generating stably integrated neighborhoods. Many neighborhoods are integrated for a brief period of time, usually when blacks or Hispanics first move in, but the vast majority of these neighborhoods then undergo transition from largely white to largely minority.

Neighborhood Preference and Prejudice

At one level, there is widespread agreement about the mechanics of neighborhood racial and ethnic transition (Schelling 1972; Yinger 1986b, 1995; Downs 1992). In particular, stable integration cannot be maintained unless the preferences of whites and blacks (or whites and Hispanics) meet certain conditions.

Consider an existing all-white neighborhood. No racial integration will take place there unless at least one black family is willing to be a pioneer. Moreover, once blacks move in, integration cannot be maintained at any given racial composition unless enough whites and blacks are willing to live there to make that composition possible. If an insufficient number of whites is willing to live there, the neighborhood has passed what is called a tipping point, and it will “tip” from all-white to all-black.

Survey evidence indicates that the neighborhood preferences of blacks and Hispanics do not constitute a major barrier to integration. A 1992 Detroit survey found, for example, that most blacks prefer to live in an integrated neighborhood where blacks make up at least 50 percent of the population and that almost all blacks would be willing to move into an integrated neighborhood where the black population share fell between one-third and three-quarters (Farley 1993; Farley et al. 1993). Moreover, 28 percent of blacks are willing to be pioneers, that is, to be the first black to move into a white neighborhood. A survey of black attitudes in 1990 by the National Opinion Research Center (NORC) paints a similar picture for the nation as a whole (Farley 1993). The limited available evidence indicates that Hispanics’ attitudes toward integration with non-Hispanic whites are similar to those of blacks (Clark 1991).

In contrast, the neighborhood preferences of whites pose a serious obstacle to stable integration. The 1992 Detroit survey reveals that 4 percent of whites would move out of a neighborhood that was 7 percent black, 15 percent would move out of a neighborhood that was 20 percent black and 41 percent would move out at 33 percent black. The 1990 NORC survey gives similar results. Therefore, with an average set of whites from Detroit, integration could be maintained in the short run at 7 or 20 percent black, but not at 33 percent black. The limited available evidence suggests similar, but somewhat weaker, white aversion to living with Hispanics (Farley 1993; Clark 1991).

Because many people move for non-racial reasons, stable integration in the long run requires whites to choose to move into an integrated neighborhood. On this point the Detroit survey results are even less encouraging. Twenty-seven percent of whites said they would not be willing to move into a neighborhood that was 7 percent black, and this percentage increased to 50 percent at 20 percent black and 73 percent at one-third black. Based on these attitudes, integration cannot be sustained in the long run at any racial composition.

Discrimination Past and Present

Some observers conclude that white prejudice is sufficiently high to make stable integration impossible (Clark 1991; Downs 1992). This assertion goes too far. White preferences as expressed in surveys certainly constrain the opportunities for stable integration but they are not, by themselves, sufficient to prevent integration altogether. In fact, white preferences are only one part of a discriminatory system that magnifies and reinforces the dynamic in the tipping model. Without the other elements of this system, stable integration would surely occur in many neighborhoods.

To see why white preferences alone are not sufficient to rule out integration everywhere, one must first recognize that surveys identify average preferences, not universal preferences (Yinger 1986b). The Detroit area, for example, contains over one million white households. According to the Detroit survey, 30 percent, or over 300,000 households, are willing to move into a neighborhood that is 53 percent black and 44 percent, or over 440,000 households, are willing to move into a neighborhood that is one-third black. There are enough willing white households to integrate many neighborhoods.

In addition, one must recognize that whites’ neighborhood preferences are not innate but are rather a product of past discrimination in housing and other markets. The distinction between blacks and whites (or between Hispanics and non-Hispanic whites) has no intrinsic power but has gained power in American society because of a long history of discrimination against blacks and Hispanics and the resulting disparities in social and economic outcomes. Whites who prefer white neighborhoods do so because they believe that blacks or Hispanics are inferior, find support for this view in the relatively poor average outcomes for these minority groups, and, because of extensive segregation, rarely experience the kind of interracial contact that breaks prejudice down. The fiction of black or Hispanic inferiority that is at the heart of white prejudice is thus supported by a powerful vicious circle: Prejudice builds on observed disparities in social outcomes, is protected by the lack of contact that goes with segregation, and then supports the continuing discrimination by which these disparities and this segregation are preserved.

Stating that white prejudice is a cause of segregation is equivalent, therefore, to stating that past discrimination continues to promote segregation through its legacy of white prejudice. The common conclusion by scholars that segregation is caused by both prejudice and discrimination provides a way to separate the role of past and current discrimination, but the scholarly literature gives no support to the claim that segregation is inevitable because whites “simply” do not want to live with blacks or Hispanics.(7)

Neighborhood, market, and government institutions also play an important role in neighborhood transition. The actions of real estate brokers, lenders, and government officials can magnify or minimize the forces that cause racial or ethnic transition. For example, many dramatic cases of blockbusting, in which whites are encouraged to flee so blacks can move in (and profits can be made), have been documented (Ginsberg 1975; Goodwin 1979). As we will see, however, community groups, real estate brokers, and public agencies in a few places have acted together to break the vicious cycle and maintain integration.

In short, without active intervention by community groups and local government, past and current discrimination–not neutral market forces and innate preferences–virtually eliminate integration as a option even for families who prefer it. Although ongoing efforts to attack current discrimination will undoubtedly weaken somewhat the forces that promote neighborhood transition, these forces are powerful and self-reinforcing, and current fair housing enforcement efforts probably will have little impact on overall levels of residential segregation.

What the Federal Government Has Done to Support Integration

Neighborhood integration has never been high on the list of federal priorities, and the contributions of the federal government to neighborhood integration have been both positive and negative.

On the negative side, federal public housing provides many of the most segregated neighborhood environments in the country. In 1993, 69 percent of the tenants in federal public housing were black or Hispanic. This figure is even higher, 90 percent, in large cities (see HUD 1995). In fact, it is pretty clear that the level of segregation is even higher in public housing projects than it is in the private housing market.

On the positive side, for the past two decades, the federal government as provided rental certificates or vouchers that subsidize rents for low-income tenants and, in principle, enable recipients to search for housing in a wide range of neighborhoods. By 1997, about 1 million households received subsidies of this type, mostly in the form of Section 8 certificates, named after the legislative clause that authorized them. For two reasons, however, these housing subsidies have had little impact on neighborhood integration. First, most recipients do not have information about housing options in neighborhoods far removed from the one in which they live before receiving the subsidy. As a result, black and Hispanic recipients of these subsidies rarely search, let alone move, very far from the low-income, minority neighborhoods where they start out, Second, these housing subsidies are administered by individual public housing authorities, or PHAs, and until recently the subsidy received in the jurisdiction of one PHA could not be used for housing in the jurisdiction of another PHA. Thus, city residents who received housing subsidies could not move to the suburbs. Thanks to reforms over the last few years, this lack of portability is now largely a thing of the past, but it was a formidable barrier to mobility for many years.

The positive and negative elements of federal policy came together in a famous lawsuit against the Chicago Housing Authority (CHA) and HUD that was filed in 1966. The plaintiffs, led by Dorothy Gautreaux, were black public housing tenants who argued that the CHA discriminated both in the selection of sites for public housing, with a strong tendency to put projects in largely minority neighborhoods, and in the placement of tenants, with a strong tendency to place minorities only in minority projects. The courts agreed with the plaintiffs, and on various appeals, HUD and CHA were ordered to cooperate and to find a metropolitan solution to the racial segregation in Chicago’s public housing. This approach was ratified by the U.S. Supreme Court in 1976.

These court decisions led to the so-called Gautreaux Assisted Housing Program, which is administered by a Chicago fair housing group. Under this program, Section 8 rental certificates were offered, on a first-come, first-served basis, to CHA tenants and to people on the CHA waiting list. People who receive these certificates are then given assistance in finding housing throughout the metropolitan area, particularly in white, suburban neighborhoods. The assistance takes the form of searching for landlords willing to accept Section 8 tenants and providing counseling to participants.

Since its inception in 1976, the Gautreaux Program has assisted about 6,000 families, virtually all of them black, in finding housing, at a cost of about $1,000 per family per year (plus the cost of the certificates). About half of the participating families end up moving to the suburbs. The program is very popular and appears to have many desirable outcomes. A recent analysis of the program (Popkin, Rosenbaum, and Meaden 1993) reveals that the participants who moved to the suburbs were more likely to have a job than those who stayed in the city. Another study (Rosenbaum, et al 1993) that tracked children in Gautreaux families found a higher likelihood of attending college, higher employment rates for those not attending college, higher wages, and higher job benefits for children in families that moved to the suburbs than for families that moved within the city.

Additional court cases have led to similar programs in Cincinnati, Dallas, Hartford, Memphis, Omaha, Parma (Ohio), and Yonkers. A demonstration program, called Moving to Opportunity (MTO), which was designed to implement and study the Gautreaux model around the country, was proposed during the Bush Administration, passed by Congress in 1992, and initiated in five cities in 1994. The five cities are Baltimore, Boston, Chicago, Los Angeles, and New York. Unfortunately, however, MTO ran into community opposition in the Baltimore suburbs, the second year of funding was cut off, and the Clinton Administration’s proposal to extend the program beyond the original five sites was killed in Congress. This episode demonstrates the challenges facing programs that promote integration: the opposition in Baltimore came from communities that were not even eligible to receive MTO participants because their poverty rate was too high! Moreover, the experience with the original Gautreaux Program reveals no sign of serious problems in neighborhoods receiving program participants.

Although the future of so-called mobility programs is in doubt, the problems with MTO have not buried the approach totally. The Clinton Administration has taken some steps to add housing counseling for Section 8 recipients, which could greatly increase their options now that Section 8 Certificates are portable. Moreover, in 1993 former HUD Secretary Henry Cisneros proposed transforming public housing subsidies into tenant certificates, a proposal that would have greatly boosted the mobility of public housing tenants.

What Communities Have Done to Support Integration (and What the Supreme Court Says about Their Efforts)

Oak Park and Park Forest outside of Chicago and Shaker Heights and Cleveland Heights outside of Cleveland are examples of communities that have remained integrated for a long period of time (Goodwin 1979; Keating 1994; Helper 1986; Saltman 1990). These communities have used a wide range of programs in their efforts to maintain integration (Polikoff 1986; Smith 1993).

Many of these programs are designed to improve the flow of information in the housing market. Race-conscious housing counseling by a private or government housing center encourages homeseekers to consider moving into neighborhoods where their own racial or ethnic group is not concentrated. Affirmative marketing by cooperating real estate brokers informs customers about housing possibilities in such neighborhoods. Collection and dissemination of racial or ethnic information about neighborhoods, such as the racial and ethnic composition of current residents and current homeseekers, by a private or government housing center is used to prevent rumors and misperceptions that often arise in unregulated episodes of racial transition.

Another set of programs attempts to boost neighborhood quality and thereby offset the widespread perception that neighborhood quality inevitably declines when racial or ethnic transition occurs. (This perception primarily reflects the fact that racial and income transition often go hand in hand.) Some programs maintain housing quality in changing neighborhoods, often with strict code enforcement. Other programs maintain or even boost the quality of public services, especially schools, in changing neighborhoods.

A third type of program is aimed at preventing behavior that fosters neighborhood transition. Some programs attempt to combat racial and ethnic discrimination in housing, especially racial and ethnic steering. Steering and other forms of discrimination by real estate agents have the opposite impact of affirmative marketing; that is, they promote segregation. Programs to combat housing discrimination therefore can play an important role in promoting integration. Anti-blockbusting ordinances, such as bans on unwanted solicitation of homeowners by real estate agents and bans on the posting of for-sale signs in front of houses, also have been used to prevent some of the worst kinds of blockbusting behavior.

Finally, some programs make payments to individuals to support pro-integrative behavior. Shaker Heights, for example, has made low-interest loans to families (mostly white) who move into areas where their group is underrepresented, and Oak Park has provided home equity insurance to ease fears of declining property values.

The legality of integration was first addressed in the debate over the 1968 Fair Housing Act. During this debate, sponsors of the legislation clearly identified racial integration as a goal, but were not clear whether the government should do more to promote it than to attack discrimination. The courts generally have sided with those who claim that integration is a legitimate federal objective under the Fair Housing Act. In a 1977 case the U.S. Supreme Court acknowledged “the vital goal this ordinance serves: namely promoting stable, racially integrated housing.” The Court went on to say, “There can be no question about the importance of achieving this goal. This Court has expressly recognized that substantial benefits flow to both blacks and whites from interracial association and that Congress has made a strong national commitment to promote integrated housing” (Polikoff 1986).

Although the Supreme Court has affirmed integration as an objective, it also has set tough constitutional standards, a three-part “strict scrutiny” test that must be met by any race-conscious policy, including one to promote integration. Such a policy must “further a compelling government interest,” it must be “necessary and effective for dealing with the issue and designed” specifically to address it, and it “must not stigmatize the minority group as inferior” (Smith 1993). Even if it meets these standards, an integration policy also must not violate the Fair Housing Act.

These tests, which place severe constraints on any policy designed to promote or maintain integration, have been applied to several types of integration maintenance policies. Courts have ruled, for example, that quotas are acceptable only under very limited circumstances. Starrett City, a large housing development in New York City, attempted to prevent racial tipping by placing a ceiling on the share of minorities in any building (and indeed on any floor). As a result, minorities spent much longer on the waiting list than did whites–a form of discrimination (Yinger 1986a). The Supreme Court ruled in 1987 that this ceiling quota was not permissible.

Some other integration maintenance policies have been accepted by the Supreme Court. In a 1973 case the Court accepted a municipal ban on for-sale signs on the grounds that the signs “had caused panic selling and white flight” (Smith 1993). In other cases, the Court accepted a municipal ban on solicitations by real estate agents and ruled in favor of a private, nonprofit housing assistance center that gave free advice only to people who wanted to make pro-integrative moves. Moreover, a recent appeals court decision concerning race-conscious counseling by the South-Suburban Housing Center in Chicago “affirmed the legality of affirmative marketing techniques and stated that any activity that serves to increase competition among all racial groups for housing is precisely the type of robust multiracial market activity that the Fair Housing Act intends to stimulate” (Freiberg 1993). The Supreme Court refused to hear this case, thereby ratifying the use of race-conscious counseling, at least under some circumstances.

HUD’s Dilemma: How to Support Integration?

Programs to support integration are an important component of an overall strategy to combat discrimination, and the U.S. Supreme Court clearly has ruled that such programs are acceptable if they meet certain conditions. So what is an appropriate federal policy to support integration?

The federal government clearly cannot, and should not, force anyone to live in an integrated neighborhood. Blacks or Hispanics in a particular urban area have a right to remain in minority neighborhoods and not take advantage of incentives to integrate, just as they have a right to live in integrated neighborhoods if they so prefer. Whites have a right to remain in largely white neighborhoods–as long as they do so without discriminating–and a right to choose integration. Even given these constraints, however, the federal government could promote integration by promoting the mobility of low-income, black and Hispanic households or by supporting integration efforts that originate at the local level.

One group in HUD strongly supports the expansion of housing mobility programs, despite the political obstacles they face. The extensive evidence from the Gautreaux Program and it successors that these programs help participants without harming their new neighborhoods convinces the people in this group that this is the way to go.

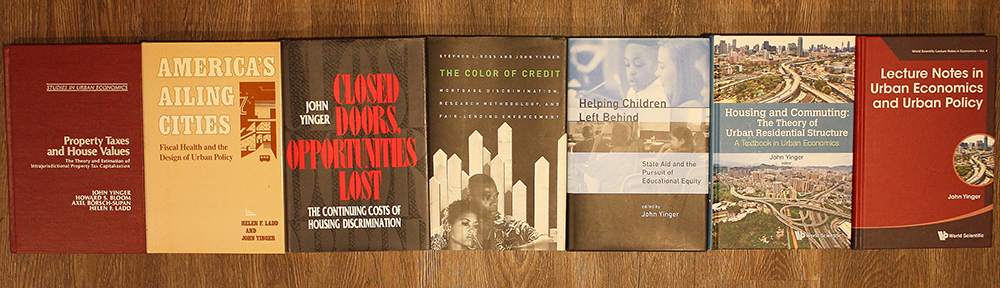

Anther group strongly supports programs to support community integration efforts. One program, first proposed by Professor John Yinger of Syracuse University, appeals to some people in this group (see Yinger, 1995). This program uses as a model the Fair Housing Initiatives Program (FHIP), which was passed in 1986. This program supports the enforcement efforts of private fair housing groups and a few local public fair housing agencies. It has funded, for example, several effective “testing” programs, which use fair housing audits for enforcement purposes, as well as programs for fair housing education and outreach. The Yinger program, called the Stable Neighborhood Initiatives Program (SNIP), builds on the FHIP approach to support efforts by state and local governments and community groups to promote integration without discriminating.

SNIP would provide grants to state and local programs according to the following rules, which are designed to maximize effectiveness while meeting the tests constructed by the Supreme Court.

No money would be given to organizations that maintain integration through either ceiling or floor quotas, even if those quotas are not part of the program for which funding is requested.

Programs that provide race-conscious counseling would be eligible for funding, but only if they were accompanied by a commitment to prevent discrimination–that is, only if they expand choice instead of restricting it.

The maximum grant size would be greater in neighborhoods (i.e., census tracts) with more balanced integration. In particular, the largest grants would available in neighborhoods in which at least 40 percent of the population is white and at least 40 percent is minority. Lower levels of funding would be available in neighborhoods in which both whites and minorities make up at least 20 percent of the neighborhood. The symmetry in these rules is important to send the signal that both white and minority neighbors are equally valued.

Community groups, local governments, and coalitions between them could compete for the grants, but only one award would be made in each jurisdiction. The maximum grant within one jurisdiction would depend on the number of neighborhoods in the jurisdiction that fell into each category defined above.

SNIP funds would be focused on programs that have proven to be effective in other communities, including:

(a) housing centers that collect and disseminate information about neighborhood change, provide housing counseling, and prevent rumors from spreading,

(b) programs to provide extra housing maintenance in changing neighborhoods,

(c) programs to boost public services, such as education or police and fire protection, in changing neighborhoods and

(d) police, recreation, or other programs that promote inter-group understanding.

New types of programs also would be considered for funding, however.

No money would be provided for integration-enhancing payments to individuals, such as the Shaker Heights loan programs or the Oak Park equity assurance plan, although agencies running such programs would not be prohibited from applying for funds for other purposes.

These types of programs have two important weaknesses. First, the payments go largely to whites, which makes them a curious method for attacking the system of discrimination. Second, they appear to reward people for their prejudice. Thus, even though these programs may be acceptable in some communities, Professor Yinger believes that these flaws make them inappropriate for federal support. Not all scholars agree. For example, DeMarco and Galster (1993) propose federal income tax credits for people who make pro-integrative moves. See also Galster (1990a, 1992a).

Maximum possible funding should be higher for programs that cover more people or that coordinate with programs in other nearby communities. Bonuses should be provided for metropolitan-level organizations that work with several integrated communities. Although SNIP funds could not be used for fair housing enforcement activities, such as testing, coordination with local or FHIP-funded enforcement programs would enhance an organization’s chance for SNIP funding.

This program would not force anyone to live in an integrated community, but it would, Professor Yinger argues, expand opportunities for both white and minority families. Thus, the program should be judged, he says, on whether it expands choice, not on whether it literally maintains integration for a long period of time in every participating community. Some communities may be able to sustain integration through SNIP-supported activities, others may be able to prevent rapid racial or ethnic transition and inter-group conflict, and still others may be able to open up neighborhoods for minorities. According to Yinger, all such outcomes would be desirable.

The Assignment

It is the spring of 1998. You work in HUD’s Office of Policy Development and Research and have been asked to investigate the best way for HUD to promote integration, if indeed it should promote integration at all. If you do not think HUD should do more to promote integration, you must explain why not, with explicit attention to the importance of segregation in our society. If you think HUD should promote integration, you should decide which type of policy would be best and develop a specific policy proposal. This policy should be as detailed as the one proposed by Professor Yinger (and could of course be his proposal, or a variation of it, if you are prepared to defend it.

The current Secretary of HUD, Andrew Cuomo, has taken a great interest in this topic and convened a conference to discuss it. You should be prepared to present and defend your proposal to the Secretary at this conference.

References

Carr, James H., and Issac F. Megbolugbe. 1993. “The Federal Reserve Bank of Boston Study on Mortgage Lending Revisited.” Journal of Housing Research 4 (2): 277-313.

Clark, William A.V. 1991. “Residential Preferences and Neighborhood Racial Segregation: A Test of the Schelling Segregation Model.” Demography 28 (February): 1-19.

DeMarco, Donald L., and George C. Galster. 1993. “Prointegrative Policy: Theory and Practice.” Journal of Urban Affairs 15 (2): 141-160.

Downs, Anthony. 1992. “Policy Directions Concerning Racial Discrimination in U.S. Housing Markets.” Housing Policy Debate 3 (2): 685-745.

Farley, Reynolds. 1993. “Neighborhood Preferences and Aspirations among Blacks and Whites.” In Housing Markets and Residential Mobility, edited by G. T. Kingsley and M. A. Turner (Washington, D.C.: The Urban Institute), pp. 161-191.

Farley, Reynolds and William H. Frey. 1994. “Changes in the Segregation of Whites from Blacks During the 1980s: Small Steps Toward a More Integrated Society.” American Sociological Review 59 (February): 23-45.

________. 1993. “Latino, Asian, and Black Segregation in Multi-Ethnic Metro Areas: Findings from the 1990 Census.” Population Studies Center Research Report No. 93-278. Ann Arbor: University of Michigan

Farley, Reynolds, Charlotte Steen, Tara Jackson, Maria Krysan, and Keith Reeves. 1993. “Continued Racial Residential Segregation in Detroit: ‘Chocolate City, Vanilla Suburbs’ Revisited.” Journal of Housing Research 4 (1): 1-38.

Freiberg, Fred. 1993. “Promoting Residential Integration: The Role of Private Fair Housing Groups.” In Housing Markets and Residential Mobility, edited by G.T. Kingsley and M.A. Turner (Washington, D.C.: The Urban Institute), pp. 219-242.

Galster, George C. 1992a. “The Case for Racial Integration.” In The Metropolis in Black and White: Place, Power and Polarization (New Brunswick, NJ: Center for Urban Policy Research), pp. 270-285.

________. 1992b. “Research on Discrimination in Housing and Mortgage Markets: Assessment and Future Directions.” Housing Policy Debate 3 (2): 639-683.

________. 1990a. “Federal Fair Housing Policy: The Great Misapprehension.” In Building Foundations, edited by D. DiPasquale and L.C. Keyes (Philadelphia: University of Pennsylvania Press), pp. 137-156.

________. 1990b. “Racial Discrimination in Housing Markets During the 1980s: A Review of the Audit Evidence.” Journal of Planning Education and Research 9: 165-175.

________. 1990c. “Racial Steering by Real Estate Agents: Mechanisms and Motives.” Review of Black Political Economy 19 (Summer): 39-63.

________. 1990d. “Racial Steering in Urban Housing Markets: A Review of the Audit Evidence.” Review of Black Political Economy 18 (Winter): 105-129.

Galster, George C., Fred Freiberg, and Diane Houk. 1987. “Racial Differences in Real Estate Advertising Practices: An Exploratory Analysis.” Journal of Urban Affairs 9: 199-215.

Galster, George C., and W. Mark Keeney. 1988. “Race, Residence, Discrimination, and Economic Opportunity: Modeling the Nexus of Urban Racial Phenomena.” Urban Affairs Quarterly 24 (September): 87-117.

Ginsberg, Yona. 1975. Jews in A Changing Neighborhood: The Study of Mattapan. New York: The Free Press.

Goodwin, Carole. 1979. The Oak Park Strategy: Community Control of Racial Change. Chicago: The University of Chicago Press.

Helper, Rose. 1986. “Success and Resistance Factors in the Maintenance of Racially Mixed Neighborhoods.” In Housing Desegregation and Federal Policy, edited by J. M. Goering (Chapel Hill: The University of North Carolina Press), pp. 170-194.

Jackman, Mary R., and Marie Crane. 1986. “‘Some of My Best Friends Are Black…’: Interracial Friendship and Whites’ Racial Attitudes.” Public Opinion Quarterly 50: 459-486.

Keating, W. Dennis. 1994. The Suburban Racial Dilemma: Housing and Neighborhoods. Philadelphia: Temple University Press.

Kushner, James A. 1992. “Federal Enforcement and Judicial Review of the Fair Housing Amendments Act of 1988.” Housing Policy Debate 3 (2): 537-599.

Massey, Douglas S., and Nancy A. Denton. 1993. American Apartheid: Segregation and the Making of the Underclass. Cambridge, MA: Harvard University Press.

Munnell, Alicia H., Lynn E. Browne, James McEneaney, and Geoffrey M. B, Tootell. 1992. “Mortgage Lending in Boston: Interpreting HMDA Data.” Federal Reserve Bank of Boston Working Paper No. 92-7, October.

Polikoff, Alexander. 1986. “Sustainable Integration or Inevitable Resegregation: The Troubling Questions.” In Housing Desegregation and Federal Policy, edited by J. M. Goering (Chapel Hill: The University of North Carolina Press), pp. 43-71.

Popkin, Susan J., James E. Rosenbaum, and Patricia M. Meaden. 1993. “Labor Market Experiences of Low-Income Black Women in Middle-Class Suburbs: Evidence from a Survey of Gautreaux Program Participants.” Journal of Policy Analysis and Management 12 (Summer): 556-574.

Rosenbaum, James E., Nancy Fishman, Alison Brett, and Patricia Meaden. 1993. “Can the Kerner Commission’s Housing Strategy Improve Employment, Education, and Social Integration for Low-Income Blacks?” North Carolina Law Review 71 (June): 1519-1556.

Saltman, Juliet. 1990. A Fragile Movement: The Struggle for Neighborhood Stabilization. New York: Greenwood Press.

Schelling, Thomas. 1972. “A Process of Residential Segregation: Neighborhood Tipping.” In Racial Discrimination in Economic Life, edited by A. Pascal (Lexington, MA: Lexington Books), pp.

Schuman, Howard, Charlotte Steeh, and Lawrence Bobo. 1985. Racial Attitudes in America. Cambridge, Mass.: Harvard University Press.

Simpson, George E., and J. Milton Yinger. 1985. Racial and Cultural Minorities: An Analysis of Prejudice and Discrimination, 5th Edition. New York: Plenum Press.

Smith, Richard A. 1993. “Creating Stable Racially Integrated Communities: A Review.” Journal of Urban Affairs 15 (2): 115-140.

Turner, Margery A. 1992. “Discrimination in Urban Housing Markets: Lessons from Fair Housing Audits.” Housing Policy Debate 3 (2): 185-215.

Turner, Margery A., Maris Micklensons, and John G. Edwards. 1991. Housing Discrimination Study: Analyzing Racial and Ethnic Steering. Washington, D.C.: U.S. Department of Housing and Urban Development.

Turner, Margery A., Raymond Struyk, and John Yinger. 1991. Housing Discrimination Study: Synthesis. Washington, D.C.: U.S. Department of Housing and Urban Development.

Turner, Margery A., and Ronald Wienk. 1993. “The Persistence of Segregation in Urban Areas: Contributing Causes.” In Housing Markets and Residential Mobility, edited by G.T. Kingsley and M.A. Turner (Washington, D.C.: The Urban Institute), pp. 193-216.

U.S. Department of Housing and Urban Development. 1995. The State of Fair Housing, 1993. Washington, D.C.: U.S. Government Printing Office.

Wienk, Ronald E., Clifford E. Reid, John C. Simonson, and Frederick J. Eggers. 1979. Measuring Discrimination in American Housing Markets: The Housing Market Practices Survey. Washington, D.C.: U.S. Department of Housing and Urban Development.

Yinger, John. 1995. Closed Doors, Opportunities Lost: The Continuing Costs of Housing Discrimination. New York: Russell Sage Foundation.

________. 1986a. “Measuring Discrimination with Fair Housing Audits: Caught in the Act.” American Economic Review 76 (December): 881-93.

________. 1986b. “On the Possibility of Achieving Racial Integration through Subsidized Housing.” In Housing Desegregation and Federal Policy, edited by J. M. Goering (Chapel Hill: The University of North Carolina Press), pp. 290-312.

Endnotes

- This case was written by Professor John Yinger solely for the purposes of class discussion.

- This case uses the terms “African American” and “black” as synonyms, and uses the term “Hispanic,” which is the term used by the U.S. Census, to designate people who can trace their ancestors back to Spain (or Portugal), usually through Puerto Rico or some country in South or Central America or the Caribbean, such as Cuba or Mexico. According to the Census usage, Hispanics can be of any race.

- Munnell et al. (1996). This study is controversial, and its methods and data have been criticized. However, its methods are conservative (see Yinger, 1995) and a detailed reexamination finds no evidence that its conclusions are driven by data problems (see Carr and Meglougbe, 1994).

- Extensive evidence supports the link between segregation and prejudice. Between 1958 and 1972, for example, when many school desegregation orders were implemented in the South, the share of Southern whites who said they would not “have any objection to sending your children to school where half of the children are black” rose from 20 to 66 percent (Schuman, Steeh and Bobo 1985, Figure 2.4). Moreover, many studies support the “contact hypothesis,” which says that equal status contacts between groups tend to lower inter-group prejudice (Simpson and J. Milton Yinger 1985, ch. 17; Jackson and Crane 1986).

- Several studies provide evidence for this view. Analysis of 1981 audit data from Boston revealed particularly high discrimination against blacks in stable, white areas and no discrimination against blacks in several changing neighborhoods into which whites were no longer moving (Yinger 1986a). Another study based on sales audits conducted in Memphis and Cincinnati during the mid 1980s found that if the initial request was for a house in an integrated neighborhood, the white auditor, but not the black, was shown other houses in white areas (Galster 1990c). These two results are confirmed by Yinger (1995).

- This role of segregation is supported by Galster and Keeney (1988), who find that urban areas with more segregation have a higher incidence of housing discrimination.

- Most scholars have listed three principal causes of segregation: prejudice, discrimination, and income disparities. (Income disparities are another part of the legacy of past discrimination.) For recent discussions, see Farley and Frey (1994), Galster (1992b), Massey and Denton (1993), Turner and Wienk (1993), and Yinger (1995).