SYRACUSE UNIVERSITY

The Maxwell School of Citizenship and Public Affairs

PAI 735/ECN 635

State and Local Government Finance

Professor Yinger

Case: Financing Schools in Michigan1

On March 15, 1994, voters in Michigan completed a radical transformation in the financing of their elementary and secondary schools by voting overwhelmingly for Proposal A. This proposal calls for an increase in the state sales tax combined with a guaranteed of a state grant of at least $4,200 per pupil for every school district in the state. This transformation began in July, 1993, when the state legislature voted to cut $7 billion in local property taxes for schools without naming a source of revenue to replace it. After extensive debate, the Governor, Republican John M. Engler, and the Legislature worked out Proposal A, which is a constitutional amendment, along with a legislative back-up plan in case Proposal A did not pass. Both Proposal A and the back-up preserve the property tax cut and boost state grant to schools, but Proposal A funds the grant increase primarily though a sales tax hike, whereas the back-up plan called for higher income taxes. Seventy percent of the state’s voters selected Proposal A, thereby clearly demonstrating their preference for the sales tax version. The new proposal takes effect on May 1.

Background

Although the steps Michigan has taken are unique, the circumstances that led to them are shared to some degree by most other states.

First, Michigan voters were fed up with their high and rising property taxes. In fact, Michigan ranked 8th in the country in its property tax burden. The desire for property-tax relief was strong even in districts with good schools. “With the aging population, 70 percent of voters do not have kids in the schools and lowering the property tax was a much greater priority for them,” said John Kelly, a State Senator from Grosse Point, an affluent Detroit suburb. In nearby Bloomfield Hills, the state’s richest community where Lee Iacocca and Isiah Thomas live, 88 percent of the voters supported Proposal A.

In 1993, voter discontent with high property taxes boiled over in the town of Kalkaska, which is near the northern end of Michigan’s lower peninsula. Voters there, who already paid over $1,000 in school property taxes on average despite fees for sports and other school-related activities, refused to vote for a property tax increase requested by the local school board, and the Kalkaska schools were forced to shut down three months early. With Proposal A, school revenue in Kalkaska will increase from $3,800 to $4,200 per pupil, but school officials there are still concerned about making ends meet because of several new state mandates included in the proposal. “The only thing I hope,” said Doyle Disbrow, the Kalkaska Superintendent of Schools, “is that the Legislature with the Governor’s help at least makes sure the funding is there for schools over the next few years.”

This issue resonates with voters around the country. “Property taxes have a way of being a good issue for candidates of either party,” says Chris Pipho, an education finance expert with the Education Commission of the States in Denver. “When the public feels that property taxes are too high, politicians have to rise to that occasion.”

Second, the system of elementary and secondary education in Michigan displayed severe inequities, with spending of only $3,200 in the poorest district compared to $10,400 in Bloomfield Hills. These spending differences undoubtedly understate the existing inequities in educational outcomes because they do not account for cost differences, which tend to favor richer districts. The Detroit Public Schools, for example, are the nation’s seventh-largest district, with 169,000 students, and are located in one of the nation’s poorest cities, with a 1990 poverty rate of 32.4 percent. This district faces massive organizational problems, deteriorating facilities, and few family resources to support school programs.

Similar disparities exist in other states. In New York, for example, the poorest 10 percent of districts spend $5,670 on average, whereas the richest 10 percent of districts spend $11,265. Moreover, twenty-eight other states are confronted with lawsuits concerning the equity of their method for financing elementary and secondary education. Many of these states will be keeping a close eye on the impacts of Proposal A. According to Steven D. Gold, Director of the Center for the Study of the States at SUNY, Albany, “The mere fact that Michigan has done this means that other states are going to think about it.”

Proposal A

Proposal A increases the state sales tax, which applies to all purchases except food, prescription drugs and heating fuels, from 4 to 6 percent. Because Michigan’s old 4 percent rate was relatively low, this increase brings Michigan about up to the national average rate; it will raise approximately $2 billion in revenue. In addition, Proposal A increases the tax on cigarettes from 25 to 75 cents per pack, an increase that is expected to bring in another $350 million, and imposes a new real estate transfer tax. The revenue from these tax increases, which is constitutionally set aside for school funding, is estimated to be $2.1 billion dollars, slightly more than the $1.9 billion taxpayers will save from reductions in their property taxes.

Proposal A also establishes a guaranteed foundation grant of $5,000 per pupil for all school districts. This grant will be phased in gradually, with a minimum grant of $4,200 in the first year. Districts currently spending more than $4,200 per pupil are guaranteed a revenue increase of at least $160 and no more than $250 per pupil. The $4,200 minimum is higher than the amount spent by 119 of the state’s 553 school districts in 1993-94. The proposal also establishes several new state requirements for schools and allows districts and higher educational institutions to sponsor public school academies.

Property taxes are not completely eliminated under Proposal A. First, a new state-wide property tax will be levied, with the revenue dedicated to schools. To be specific, the state rate on homestead property (i.e. owner-occupied housing) will be set at 6 mills (0.6 percent) and the state rate on nonhomestead property will be set at 24 mills. These tax rates are unlikely to increase, because Proposal A also states than any law increasing the allowable millage rates must be passed by a 3/4 majority in the state legislature.

Second, local school districts are allowed to levy a “foundation” tax of 18 mills on nonhomestead property. Third, school districts with revenues above $6,500 per pupil in FY1993-4 may levy sufficient millage to generate a $160 per pupil increase in revenue for FY1994-5. This tax must be levied on homestead property alone until the homestead rate equals the nonhomestead rate and will be rolled back in future years if the district’s revenue grows faster than inflation. Fourth, school districts can, with voter approval, levy “enhancement” taxes of up to 3 mills in 1994 through 1996. After 1996, these enhancement taxes must be done at a regional level, corresponding to intermediate school districts or ISDs, which provide special and vocational education.

Finally, and perhaps most importantly, property assessment increases will be capped at 5 percent or the rate of inflation, whichever is less. These assessment limits, like those set by Proposition 13 in California, will be removed when a house sells.

After all these changes, property taxes are expected to provide less than 10 percent of school revenue.

Under the fall-back plan that would have taken effect if Proposal A had not passed, the state income tax would have been increased from 4.6 to 6 percent and the state property tax rate on homestead property would have been set at 1.2 percent instead of 0.6 percent.

Analysis

Proposal A was not without its critics. Beverly Wilcow, executive director of the Michigan Education Association, a 127,000 member teachers’ union, says that “The proposal is shaky.” Ms. Wilcow argues that sales tax receipts are too volatile to be used for schools because consumers cut back spending on cars and other durable goods whenever the economy turns down. The Michigan Department of Treasury counters that state sales tax revenue grew in 19 of the last 20 years, despite several recessions.

Michigan Citizens for Fair Taxes, MCFT, argues that the new financing scheme will place an unfair burden on renters and the elderly, because both groups were, to some degree, exempt from the property tax but will be hit hard by the sales tax increase. Renters avoided the property tax because their mobility made it difficult for landlords to pass the tax through in the form of higher rent, and the elderly avoided the property tax because of the state’s circuit breaker law. Supporters of the proposal rebut these claims by pointing to another provision of Proposal A, namely an increase in renters’ homestead credit against the state income tax. MCFT also points out that sales taxes, unlike property taxes, cannot be deducted on federal income taxes. As a result, a shift from property to sales taxes constitutes a significant increase in federal taxes paid by Michigan’s citizens. Proponents of Proposal A respond that sales taxes can be exported to tourists.

In addition, MCFT argues that the plan is seriously under funded. Although Proposal A increases the sales tax and a few minor taxes, adds a new state property tax, and dedicates a portion of state income tax revenue to schools, it cannot ensure that state revenue will be sufficient to pay for the guaranteed grants to schools. Moreover, Proposal A actually cuts the state income tax rate from 4.6 to 4.4 percent. If the money is not there, the proposal does not say what state taxes will be raised or what other state programs cut to meet the state’s guarantee. Estimates provided by MCFT, which are disputed by the Michigan Department of Treasury, put the shortfall at $800 million for the first year.

Finally, several academics have pointed out that the plan retains serious inequities in school finance and might not even withstand a constitutional challenge. Not only can the richer districts supplement their state grants with property taxes levied against their high property wealth, but the proposal does not in any way recognize that $1 of spending per pupil does not have the same impact on educational outcomes in a disadvantaged district, such as Detroit, as in a wealthy district, such as Grosse Point or Bloomfield Hills. To put it another way, $4,200 may not provide an adequate education in Detroit or in other disadvantaged districts.

The Decision

You have just been hired as head of the research department at the Education Commission of the States. Because of the widespread interest in the Michigan’s new financing scheme, you have been asked to evaluate this scheme and to recommend an approach to school finance reform that would make sense in a typical state. In other words, your assignment is to describe the key elements of Proposal A, to identify provisions that other states might want to copy, and to recommend provisions not in Proposal A that you think are important. You may address any issues you want but have been asked specifically to evaluate the desirability of (1) a shift from local property taxes to state taxes, (2) the use of sales taxes at the state level, (3) a state guarantee of a minimum spending level per pupil, and (4) the right of local districts to supplement, with limits, the revenue they receive from the state. To the extent that you find the provisions of Proposal A to be unsatisfactory in dealing with any of these issues, you may recommend alternative approaches that are more desirable.

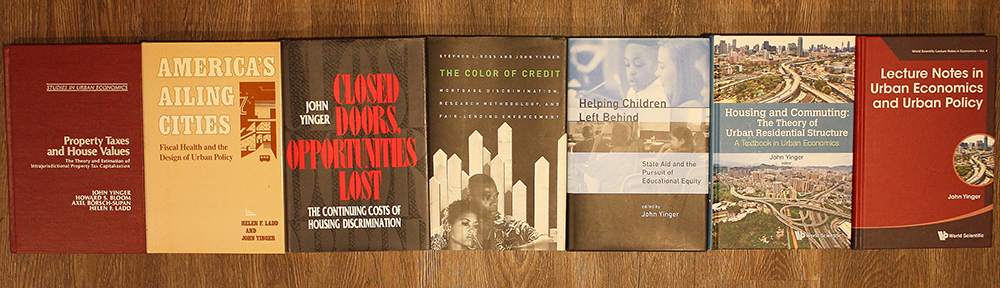

1This case was written by John Yinger for the purposes of class discussion. It draws on William Celis 3rd, “Michigan Debates Best Tax to Finance Schools,” The New York Times, March 14, 1994, p. A15; William Celis 3rd, “Michigan Votes for Revolution in Financing Its Public Schools,” The New York Times, March 17, 1994, p. A1; “Fairer Schooling for Michigan,” The New York Times, editorial, March 18, 1994, p. A28; “Rich are Wary of Michigan’s Tax Revolt,” The New York Times, March 23, 1994, p. A18; Michigan Citizens for Fair Taxes, “Proposal A Fails to Make the Grade,” February 18, 1994; State of Michigan, “School Reform and Funding: Detailed Analysis,” January 24, 1994.