Why Syracuse Should Revalue

John Yinger*

Syracuse’s property tax is in serious trouble. Property in the city has not been systematically assessed in decades and, for three reasons, complete revaluation is desperately needed.

First, the current situation seriously violates the widely accepted principle that any two taxpayers whose property has the same market value should pay the same tax. Among houses that sold for $65,000 in 1992, for example, assessments ranged from $2,250 to $7,400. Thus some people with houses in this price range had assessments–and hence tax payments–that were over three times as high as others. In the $100,000 price range, some homeowners had assessments and tax payments that were almost 2-1/2 times as high as others.

Second, the current situation violates another widely accepted principle, namely that the assessment/sales ratio should not be lower for taxpayers with more expensive houses. Unless assessments are updated, this principle is undermined because property values tend to grow more rapidly and hence assessment/sales ratios tend to fall more rapidly, for higher-income people. The systematic revaluation of several low-income neighborhoods in Syracuse over the past few years has eased this problem somewhat, but 84 percent of the houses in Syracuse with recent assessment/sales ratios over 15 percent had market values below $50,000. This is simply not fair.

Third, inaccurate assessments undermine public faith in the property tax and in city government. Taxpayers inevitably resent a property tax system in which neighbors with similar houses pay lower taxes than they do, in which people who know how to manipulate the system can get their taxes reduced, and in which decisions about revaluation–and hence about assessment procedures–are made on political grounds. Revaluation would take politics out of tax administration, where it does not belong, and restore the only fair, objective standard for assessment, namely market value.

The costs of revaluation have been greatly exaggerated. The city would have to pay a one-time cost to bring its assessment system up to date, but with current computer technology, maintaining market-value assessments would not be very expensive and might even be paid for by the savings from reduced litigation plus the subsidies from the state to cities that revalue.

Revaluation would impose losses on some taxpayers whose assessment/sales ratios are now below average. These one-time losses are a small price to pay for obtaining a fair, credible property tax. Moreover, to a large extent the losses fall on people who have benefited from the current system. In effect, long-term owners with relatively low assessments have been receiving an interest-free loan from the city, and revaluation simply requires that they repay this loan.

Finally, revaluation alone would result in a large shift in tax burden away from business property, which now has a relatively low assessment/sales ratio, onto residential property. This shift would not be desirable and, thanks to the homestead option provided by the state, it is not necessary. Once Syracuse has revalued, it can charge a higher tax rate on business than on residential property and thereby eliminate the existing inequity within property classes without shifting the tax burden onto homeowners.

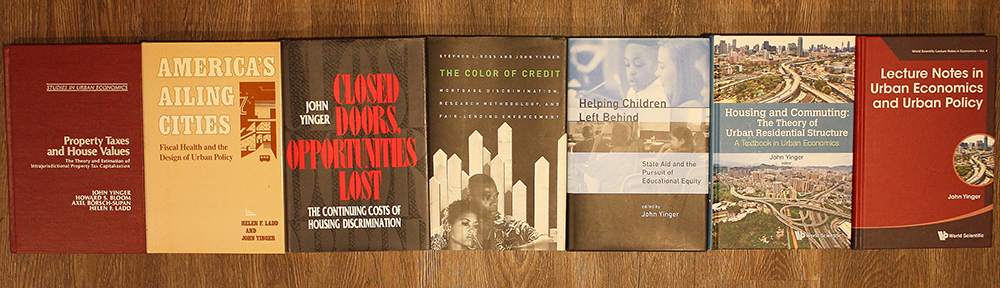

*John Yinger is a Professor of Economics and Public Administration at The Maxwell School, Syracuse University. He is the co-author of Property Taxes and House Values (Academic Press 1988) and America’s Ailing Cities (Johns Hopkins University Press, updated edition, 1991).