The Maxwell School of Citizenship and Public Affairs

PAI 735/ECN 635

State and Local Government Finance

Professor Yinger

Case: Spending Incentives in New York’s School Tax Relief Program (1)

Local property taxes in New York state are among the highest in the nation. This heavy reliance on the property tax combined with a wide range in wealth per pupil across districts is a major source of existing disparities in educational funding. It is not surprising, therefore, that many policy makers in New York have focused on property tax relief, not only as a way to gain political favor for cutting taxes but also as a way to add balance to the state’s revenue system and to reform educational finance in the state. Indeed, the most significant change in educational finance in the state in recent years, the School Tax Relief program, STAR, is a property tax relief program passed in 1997 and fully effective in 2001

A lively debate is now taking place concerning the long-run effects of STAR on educational spending in the state. Governor George Pataki, the main supporter of STAR, argues that it is simply tax relief and has nothing to do with educational spending. Moreover, he adds, STAR contains several provisions designed to make certain that spending will not rise. In contrast, several scholars have argued that STAR fundamentally alters local voter’s incentives to spend money for education and will, in fact, result in a dramatic increase in educational spending — and in property tax rates — in all districts except the big cities where the need for more revenue is greatest.

This debate is important because, if they occur, local spending increases could magnify existing educational disparities in the state, have a negative impact on the State’s economic development efforts, and greatly increase the cost of the STAR program.

Description of STAR

In five large cities in New York, (Buffalo, New York, Rochester, Syracuse, and Yonkers), the school district is a department of the city government and school property taxes are part of the city tax levy. Everywhere else in the state, school property taxes are levied by independent school districts. A homeowner’s local school property tax payment equals the tax rate selected by her school district multiplied by the assessed value of her home, which is required to be set as near as possible to its market value. The main feature of STAR is a property tax exemption that will be subtracted from assessed value, so that the tax payment becomes the rate multiplied by the excess of assessed value above the exemption. In symbols, the property tax payment, T, now equals the tax rate, t, multiplied by the assessed value, V, or T = tV. Once the STAR exemption, X, is in place, this equation becomes T = t (V – X).

When fully implemented in 2001, the STAR exemption will equal a base amount of $30,000 for the owners of owner-occupied one- to three-family houses, mobile homes, condominiums, and cooperative apartments or $50,000 if the owner is aged 65 or older with an income below $60,000. School districts must provide this exemption and the State will reimburse them for its cost. To give a simple example, consider a house worth $100,000 in a school district with a 1.5 percent property tax rate. Without STAR, the owner of this house pays a property tax of (.015)×($100,000) = $1,500, but with STAR, this owner’s tax drops to (.015)×($100,000 – $30,000) = $1,050, a tax reduction of $450, or 30 percent.

One of the key features of the STAR exemptions is that the base amount is multiplied by a “Sales Price Differential Factor,” which is the ratio of the three-year average sales price of residential property in a district’s county relative to the three-year average in the state as a whole. This factor cannot fall below 1.0. Thus, this provision greatly increases the amount of the exemption in counties with high property values. The STAR exemptions also are multiplied by an “Equalization Factor,” which accounts for the fact that not all assessing districts assess property at 100 percent of market value.

How STAR Affects Voters’ Tax-Prices and School District Spending

STAR raises many issues of concern to voters and public officials. For example, a property tax exemption promotes equity across taxpayers by lowering the burden of the property tax the most on taxpayers with the smallest property values, and therefore with the least ability to pay. However, STAR’s “Sales Price Differential Factor,” offsets this equity improvement by giving a larger tax break to taxpayers in higher-wealth counties. The basic exemption in the richest county, Westchester County, will be about $72,000, for example, compared to $30,000 in most of the state.

For the purposes of this discussion, however, another feature of STAR must be emphasized, namely the fact that it alters the “tax price” faced by voters. The tax price is the voters’ share of any increase in property taxes to pay for schools. This tax price varies widely across school districts, largely because some districts have far more commercial and industrial property than others. The tax price is lower in a district with a great deal of commercial and industrial property because much of the burden of any school tax increase falls on commercial and industrial taxpayers, not on homeowners and other voters. In effect, the tax price operates like any other price; the higher the price, the more consumers substitute away from a product toward other products. Just as consumers buy less coffee if the price of coffee is higher, they will vote for less spending on schools if the tax price is higher.

This tax-price effect is not just hypothetical. Dozens, if not hundreds, of academic studies have shown that spending (for schools and for other local public services) is higher if the tax price is lower. These results are usually expressed as an elasticity, which indicates the percentage change in spending for a one percent change in tax price. Most studies estimate that the price elasticity of demand for public services is in the -0.1 to -0.5 range. For example, a recent study of school spending in New York by two professors at the Maxwell School of Syracuse University, found that the price elasticity of demand for school spending is -0.45. In other words, a one percent increase in the tax price results in a 0.45 percent decline in school spending.

Several studies also have found that this tax-price effect can work through state aid programs. In particular, a so-called matching program is designed so that the state pays a certain share of every dollar spent on education. If the matching rate is 33 percent, for example, then state’s share of every dollar of spending approved by local voters is $0.33 and the voters themselves have to pay only $0.67. In effect, therefore, the local tax share equals one minus the matching rate. According to these studies, the higher the matching rate, and hence the lower the local tax price, the higher local spending on education.

The easiest way to derive an expression for a tax price is to combine a single voter’s budget constraint with the budget constraint for a school district. A simple version of this process begins by defining non-housing commodities, Z, which sell for a price of PZ per unit and housing, H, which sells for a price of PH per square foot2). A voter sets her income, Y, equal to her spending on non-housing commodities, PZ Z, plus her spending on housing, PH H, plus her property tax payment, tV [or t (V – X) once STAR is in place]. A district’s tax base is the sum of property values across households and can be summarized by property value per pupil, V*. A district must set spending per pupil, E, equal to total property tax revenue per pupil, tV*, plus state aid per pupil, A. With STAR in place, the district must provide exemptions equal to tX*, where X* is the total value of exemptions in the district per pupil, but the state compensates the district for these payments. In equation form:

| Without STAR | With STAR | |

| Individual Budget Constraint | Y = PZ Z + PH H + tV | Y = PZ Z + PH H + t (V – X) |

| District Budget Constraint | E = tV* + A | E = t(V* – X*) + A + tX* = tV* + A |

Now a little simple algebra leads to the tax price. With or without STAR, solving the district budget constraint for t yields t = (E – A)/V*. Substituting this expression for t into the individual budget constraint yields the following combined budget constraint:

| Without STAR | With STAR | |

| Combined Budget Constraint | Y = PZ Z + PH H + [V/V*](E-A) | Y = PZ Z + PH H + [(V-X)/V*](E-A) |

In these combined budget constraints, income is spend on three things, non-housing, Z, housing, H, and school spending per pupil above state aid, (E-A). In each case the amount consumed is multiplied by a “price.” Without STAR, the amount a voter must pay for each dollar of school spending per pupil above state aid is the value of the voter’s house divided by property value per pupil in the district, [V/V *]; in other words, [V/V *] is the voter’s tax price. Once STAR is added, the tax price drops to [(V-X)/V*].

For example, consider a district in which every house has an assessed value of $100,000 and is the home to a single student. Then without STAR, the tax price is 100,000/100,000 = 1 for every voter; when all houses are alike, each voter must pay $1 to raise spending by $1 per pupil. Adding STAR, with its $30,000 exemption, cuts the tax price in this district to (100,000-30,000)/100,000 = 0.7, which is equivalent to a 30 percent price cut.

In a less homogeneous district, voters who have a relatively expensive house will have a relatively high tax price. If the average house in a district is worth $100,000 then the owner of a house worth $200,000 faces a tax price of 200,000/100,000 = 2.0 (again assuming, for the purposes of illustration only, one pupil per household). Intuitively, any increase in the tax rate to increase spending per pupil will have twice the impact on the owner of a $200,000 house than on the owner of a $100,000 house. Moreover, STAR will have a bigger effect on the tax price of a voter with a lower-valued house (ignoring the “Sales Price Differential Factor”). When STAR is implemented, the owner of the $200,000 house will see her tax price drop from 2.0 to (200,000 – 30,000)/100,000 = 1.7, which is a 15 percent drop.

Because not all voters have the same tax price (or the same change in tax price from STAR), one cannot predict the amount of spending selected by a school district (or the change in its spending in response to STAR) without selecting a “decisive voter,” defined as the voter whose demand for spending coincides with the spending level selected by the majority of voters. The most common approach, which works well in many circumstances, is to say that the decisive voter is the one with the median house value in the community, VM. With this approach, a district’s tax price is VM / V* without STAR and (VM – X ) / V* with STAR, and the difference between these two tax prices can be used to predict how much the district’s educational spending will increase when STAR is implemented. The percentage change in tax price will, of course, also be influenced by the amount of commercial and industrial property in the district and the number of pupils per household, both of which affect V*.

The Case for a Large Spending Impact from STAR

Perhaps the most basic theorem in economics is that people substitute toward goods and services when their price goes down. Because STAR causes such large declines in tax prices, some scholars have predicted that it will result in a large increase in educational spending. In the average school district in New York, STAR will lower the tax price by 37 percent. A price cut of this magnitude could induce voters to want to spend considerably more on education. In fact, according to the price elasticity for New York cited earlier, namely -0.45, a 37 percent price cut will result in a (.37)(.45) = 16.65 percent increase in spending per pupil in the average district. To fund these spending increases, the local property tax rate would have to increase by over one-third in the average district.

This analysis does not apply to a school district in which a majority of the voters are renters. Renters demand for education is not well understood, but it is clear that the incentives facing renters are quite different than those facing owners. The most important difference is that renters may not gain from an increase in educational spending because such an increase will cause their rents to rise. Moreover, STAR applies only to homeowners. Even if the tax price for renters were well defined, therefore, it would not be affected by STAR. As a result, STAR may have no impact on spending in districts with a majority of renters, which includes all the large cities in the state.

If these predictions are correct, they have three important implications for state policy. First, they imply that the disparity in spending between suburban and city school districts will go up. New York State already faces two major law suits that claim it has not lived up to its responsibility for delivering adequate education in its large city school districts. An increase in spending disparities would not strengthen the State’s position in these suits.

Second, they imply that STAR will result in a large increase in local property taxes on commercial and industrial property. New York State is already perceived as a high-tax state, and many business leaders and public official argue that the high property taxes in the state are a serious deterrent to attracting new business. According to this widely held view, a 33 percent increase in property tax rates in the average school district would be devastating for the State’s economic development prospects.

Third, these predictions imply that the official estimates of the cost of STAR, which assume no local spending increases, are far too low. STAR obligates the State to pay each district an amount per pupil equal to tX*, where, as defined earlier, t is the districts property tax rate and X* is the total value of its STAR exemptions per pupil. If t goes up, so does the cost to the state. If the local property tax rate increases by one-third in the average district, then the overall cost of STAR to the State will also increase by one-third.

The Case Against a Large Spending Increase from STAR

For two main reasons, many commentators and public officials have rejected the argument that STAR will increase local spending on education.

First, some people argue that estimated price elasticities are simply irrelevant for STAR, which is, they say, nothing more than tax relief. Voters may spend more on education, they concede, when there is a lot of commercial and industrial property in a district to share the tax burden, but they will never make the connection between their exemptions and the “price” of education.

Second, even if voters are tempted to increase spending due to lower tax prices, STAR contains two provisions designed to prevent such spending increases. Under the first provision, STAR sets aside $25 million for a new form of state aid, called tax-freeze aid. Although the details of this new form of aid are complicated, it is designed to reward a district that increases its tax levy by less than about 3 percent per year, with the highest aid to districts that do not increase their levy at all.

Strange as it may seem, this “tax-freeze” provision does not recognize the difference between a tax rate increase and a tax base increase, so a district that succeeds in attracting a new manufacturing plant will be penalized for increasing in its tax levy, as will a district that raises its property tax rate. (This same error was made, and then corrected, in a famous property tax limitation measure, Proposition 2 ½, that was passed in Massachusetts in 1980.)

Tax-freeze aid will provide a bonus to districts that do not want to raise their tax rate. One study of STAR estimates that about one-third of districts, containing about one-quarter of the state’s students, will receive tax-freeze aid. Because there are about 2.8 million pupils in the state and the budget for tax-freeze aid is $25 million, these districts can expect to receive tax-freeze aid of about 25/[(.25)(2.8)] = $35 per pupil, on average. In other words, a district might be able to receive aid of about $35 per pupil if it holds the percentage increase in its tax levy below 3 percent. If all districts in the state were to receive tax-freeze aid, the aid per pupil would drop to 25/2.8 = $9 per pupil.

However, an increase in a district’s tax levy also results in more aid through the basic STAR exemptions. Before possible spending increases are considered, the STAR exemptions are expected to cost $2.24 billion or $800 per pupil, on average. As shown earlier, a district’s STAR reimbursement equals tX*, which is the local property tax rate multiplied by the district’s total exemptions per pupil. Thus, a 1 percent increase in a district’s tax rate, t, results in a 1 percent increase in a districts STAR reimbursements, tX*. In a district where the tax base stays constant, a 3 percent increase in the tax rate (and hence in the tax levy) results in a (.03)(800) = $24 increase in reimbursements per pupil, and a 5 percent increase in the tax rate results in a (.05)(800) = $40 increase in reimbursements per pupil. In many, if not most districts, therefore, the state aid increase associated with an increase in the local tax rate may exceed the state aid increase that results if local tax rates are frozen.

The second provision involves the rules governing a school district’s “contingency” budget, which is the amount it can spend if voters reject its spending request. (Under New York State law, a school district must seek voter approval for its budget each year.) STAR limits the growth in the contingency budget to 4 percent per year or 1.2 times the growth in the Consumer Price Index, which ever is smaller. STAR places no limits on the budgets submitted by school districts for voter approval.

The Debate

Leaders of the New York State Senate and Assembly have recognized the importance of this debate and have convened a conference to discuss it. You have been asked to make a presentation at this meeting. In particular, you have been asked to indicate whether you think STAR will have a significant impact on local educational spending and to explain in detail the reasoning behind your conclusion. Explain why you think local educational spending will be affected, if at all; how large the effect will be; and why the change in spending is relevant for state policy makers. If you think that local spending increases will occur, the conveners of this conference would also like you to suggest revisions to STAR that might minimize these increases without penalizing needy school districts or that would solve any other problems that this increases might cause. You have been asked not to evaluate STAR in general, but instead to focus on those aspects of STAR that are related to potential changes in local educational spending.

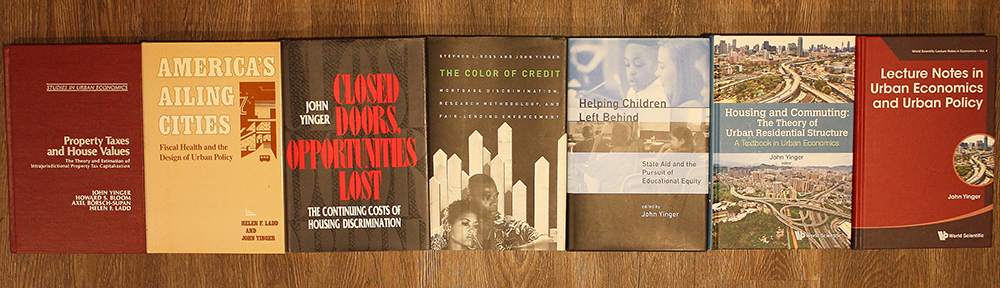

(1)This case was written by Professor John Yinger solely for the purposes of class discussion.

(2)This version of the problem leaves out some items that are not essential for the derivation of a tax price, such as household borrowing or school district revenues other than property taxes, and state matching aid.