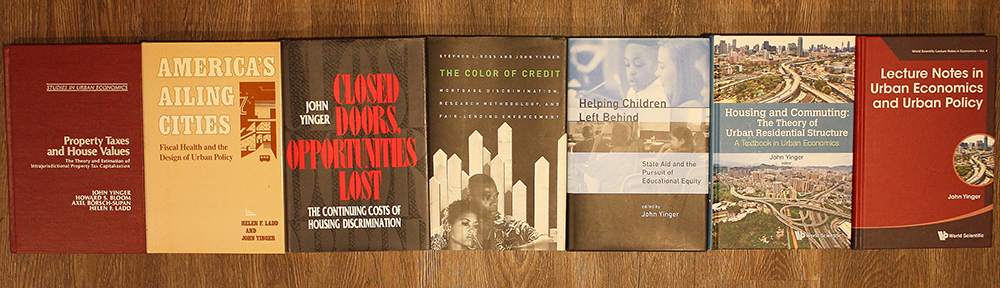

by Stephen L. Ross and John Yinger

Contents ▪ Synopsis ▪ Endorsements ▪ Reviews ▪ Excerpts ▪ Publisher ▪ Amazon ▪ Authors

REVIEWS

“Discrimination in mortgage markets is an extremely important issue … and this book makes an essential contribution to our understanding of this problem. It should be on the bookshelf of every researcher and policy maker interested in the topic.”

Abdullah Yavas, Journal of Economic Literature, March 2004, pp. 190-191.

“[T]he authors develop innovative (but highly technical) procedures to rectify weaknesses in the mortgage loan system…. All told, the authors provide an excellent summary of the available economic and statistical evidence for racial discrimination in the mortgage industry… [T]he policy sections are well-written and understandable.”

Howard Jacob Karger, Journal of Sociology and Social Welfare, September 2004, pp. 173-174.

“Ross and Yinger undoubtedly deserve an influence beyond their peer researchers. The entire lending industry, including regulators charged with fair lending enforcement would unmistakably benefit from considering the author’s conclusions and policy suggestions. In addition to introducing a new, powerful, and logical methodology, the book possesses many other remarkable strengths. First, it refrains from promoting a particular blatant agenda…. Second, Ross and Yinger treat both the theoretical framework and the empirical evidence of mortgage discrimination in a balanced and blended manner…. [T]he theories underlying the methods are well conceived and the policy implications of their findings clearly follow…. Finally, novices, dabblers, and experienced researchers alike will be well served by Ross and Yinger’s extensive bibliography…. In any library or office, the book could comfortably replace several linear feet of file drawer or bookshelf space devoted to the accumulation of prior works on the topic.”

Cynthea E. Geerdes, Journal of Affordable Housing and Community Development Law, Winter 2004, pp. 176-184.

Ross and Yinger “provide important guidance for improving the quality of research into discrimination in mortgage lending…. Scholars employing regression analysis to identify discrimination in mortgage lending will find the Ross and Yinger text an essential guide.”

Kathryn A. L. Cheever, Public Administration Review, January/February 2004, pp. 118-120.

“Their critical evaluation in Chapter 5 … provides a comprehensive overview of what is known and not known about mortgage lending discrimination … [This chapter] is as close as a serious academic book can become to a detective novel. It is essential reading for anyone tempted to undertake applied economic analysis without a full understanding of the institutional framework within which the problem being addressed is located.”

Judy Yates, The Economic Record, July 2004, pp. 264-265.

The literature on mortgage lending discrimination has been caught in a quagmire for several years…. Stephen Ross and John Yinger…bring clarity to this literature, and advance it…. In addition, the authors expose weaknesses in current fair lending enforcement and cogently propose changes that would better ensure that all forms of mortgage lending discrimination are detected…. The manuscript makes useful contributions to the literature in two areas. The first is the authors’ expanded analysis of the variation in underwriting standards across lenders based on the Boston Fed Study…. The second…is the authors’ policy recommendations, which are based on conclusions they arrive at from their extensive analyses of the loan approval data and literature…. [T]he value of the book is that it brings much needed analytical clarity to the mortgage lending discrimination debate; it offers more promising techniques for future analyses; and it provides concrete recommendations for how to develop and enforce fair lending policies.

Kelly Patterson, Contemporary Sociology, March 2004, 166-167.

Stephen Ross and John Yinger have published an important book of interest to academics and others doing theoretical, econometric, and fair-lending enforcement work related to mortgage-lending discrimination…. The Color of Credit seems destined to become as famous and controversial as the seminal studies it cites, re-evaluates, and critiques. It will become the starting point for a new generation of scholars interested in mortgage-lending discrimination as well as for the citizen activists and public officials who hope to improve our fair-lending enforcement system…. Ross and Yinger make three very important contributions to the literature on mortgage-lending discrimination. First, they undertake a scrupulous re-evaluation of the famous Federal Reserve Bank of Boston study as well as a comprehensive and painstaking review of its many critics…. Ross and Yinger’s second major contribution involves carefully describing and fatally critiquing the default approach to testing for mortgage-lending discrimination used by Gary Becker and others…. The authors’ third major contribution is to show how easy it is for an apparently race-neutral credit-scoring system to generate adverse impact discrimination against minority applicants.

Reynold F. Nesiba, Journal of Economic Issues, September 2003, pp. 1-3.